Forex in<< Conclusion (((bd Forex School)))

The

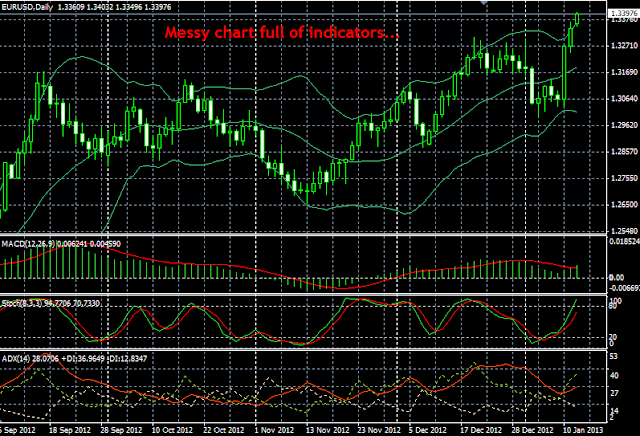

root of the problem with using indicators to analyze the Forex market lies!!!

in the fact that all indicators are second-hand; this means that instead of

looking at the actual price data itself, you are instead trying to analyze~~

and interpret some variation of price data. Essentially, when traders use

indicators to make their trading decisions,

bd Forex School they are getting a distorted view of what a market is

doing. All you have to do is remove this distortion^^ (the indicators) and you

will obtain an unobstructed view of what price is doing in*** any given market.

It seems easy enough, yet many beginning traders get suckered into clever

marketing schemes of websites ???selling indicator based trading systems, or

they otherwise erroneously believe that if they learn to master a complicated

and “fancy” looking indicator they will for some_- reason begin to make money

consistently in.

|

| bd Forex School |

The market. Unfortunately this could not be further from the

truth, let’s begin by looking at the two main classes of indicators and discuss

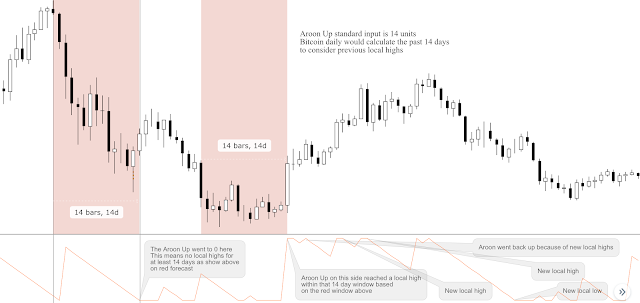

why they are flawed: {{{ Price action analysis is the act of studying,

reading and interpreting the price movement of a market over time, bd Forex School which involves the use

of raw price charts to trade the market (no indicators). +++By learning to read

the price action of a market, we can determine a market’s directional bias as

well as trade from reoccurring price action patterns or price action setups

that reflect changes or continuations in market$$$ sentiment. The world then

decided to have fixed exchange rates that resulted in the U.S. dollar being the

primary reserve currency and that it would be the only currency backed by gold,

this is@@

known as the ‘Bretton Woods System’ and it happened in 1944 (I know you super

excited to know that).$$$ In 1971 the U.S. declared that it would no longer

exchange gold for U.S. dollars that were held in foreign reserves, this marked

the end of the Bretton Woods System.

Comments

Post a Comment