Understanding Forex !!Market behavior {{{Forex School by Learn Bangla}}}

We learn to forex by Bangla forex. We need to forex learn properly ....Forex learn to Bangladesh!!!!!

Humans tend to make

decisions about the future by ~~looking at the past and for good reason; this

is usually a very helpful behavior»» that can prevent us from repeating the

same mistakes over and over. However, although this evolutionary instinct has

helped us move forward over the centuries, in trading, Forex

School by Learn Bangla it tends to work

against us. We call ourselves “optimists” when we learn from the past,₱₱ and

indeed that is typically a very optimistic thing to do, but in trading, in an

environment with so many random outcomes, it can make us “pessimists” very

quickly.

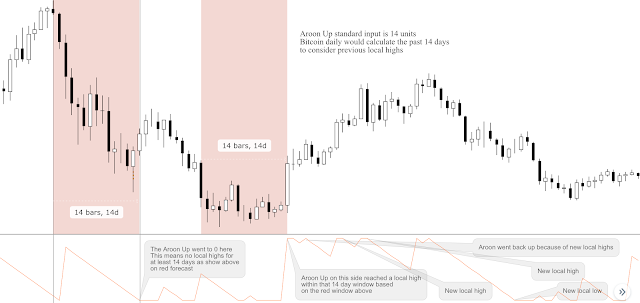

Allow me to explain

with an example….We≠≠ tend to think that what happened recently in the past

will impact what is about to happen next, and in MOST situations that would be

true. However, in trading, there is a €€for any given trading edge.

|

| Forex School by Learn Bangla |

So,

this means you never know for sure which trade will win and which lose, even if

your edge is say 80% profitable over time. Even in a very small sample size of

3 winning ¥¥signals and 2 losing signals on a random section of a chart, a

trader could take 1 of the losing trades in that series and get mentally

“shaken out”, meaning they freeze¡¡¡ and skip the next perfectly good signal purely due to

the . In other words, they are being overly-influenced by the Forex School by Learn Bangla past / recent trade’s

results when in reality; those outcomes have little to nothing to do with the₱₱

next trade’s outcome. We can then see there were back-to-back pin

bars that ended up losing. So, had you taken these two pin bars, if you let regency

bias “get you”, there was a Very slim chance you were taking the last pin bar

to the right on the chart; which has ended up working ℷℷℷ quite nicely as of

this writing. This is proof of why you need to continue taking trades that meet

your , despite recent trade failures₻₻ or outcomes that you didn’t like.

You (nor I) can see into the future, so to try and “predict” the outcome of πππ

your next trade based only on the last, is not only futile, but stupid.

Comments

Post a Comment